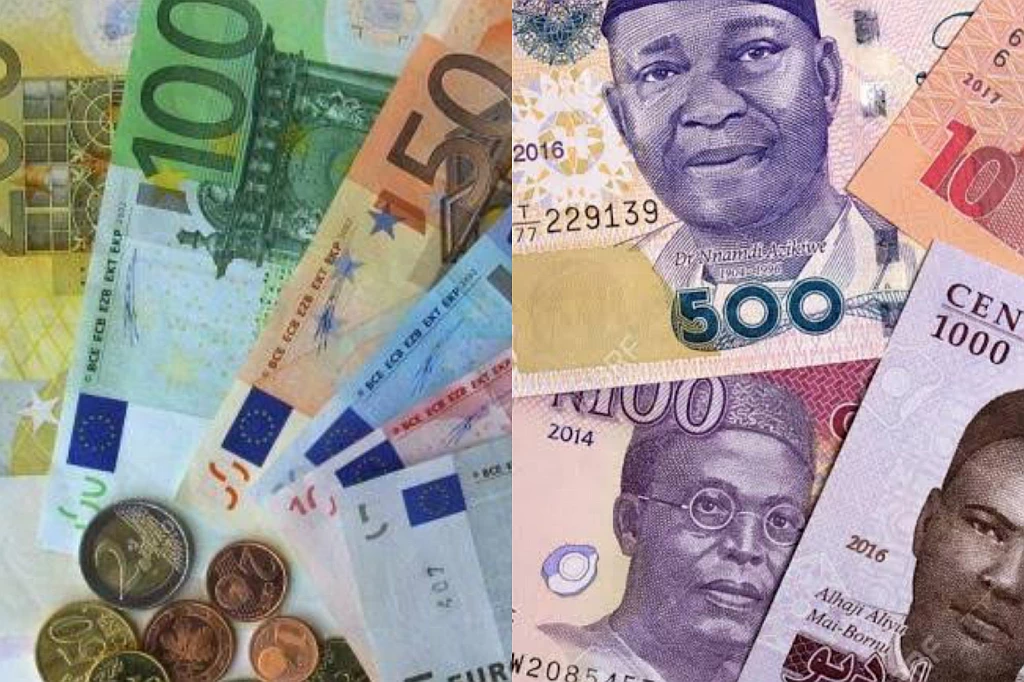

Rising interest rates and a sliding Naira would hurt Nigerian companies that rely on foreign loans. A company with no natural hedges and partly hedged external borrowings could become a potential candidate for rating downgrade if its revenue is fully realised in the local currency.

Sometimes a company only covers currency risk for its interest payments to foreign subscribers to its bonds while the principal is left uncovered. If a local borrower is facing principal repayments now, this dampens creditworthiness, raising the debt burden. As things are, Nigerian companies pay more Naira per unit of the dollar now.

A dollar-denominated borrowing coupled with the immediate impact of inflation is a double whammy on companies that source revenues fully in Naira. Companies rated in the lower rank of Investment Grade and High Yield category may face rating downgrades first due to the Naira depreciation.

The risk of sovereign default and exchange rate fluctuations are inextricably linked. The depreciation of a country’s currency is often a reflection of poor economic conditions. Default events tend to be associated with currency devaluation. Such devaluation may either strategically support the competitiveness of the domestic economy or penalise a country’s growth due to increased borrowing costs or reduced access to international capital markets.

There could also be worries over a country’s revenue sources and its ability to repay a debt when it is due. An example of such a case is the Nigerian Eurobonds. The Eurobonds currently have a yield of 14.36%. This is as against a yield at issue, in March 2022, of 8.375%. The Bonds are also being traded at a discount of $77.43. The rise in the yields of the Eurobonds stopped the country from issuing a fresh $950m Eurobonds in June.

The fears over the country’s revenue stem from the low production of oil compared to the budgeted levels as well as the influence of subsidy and debt servicing on the revenue of the country. The country currently produces 1.158 million barrels per day as against the budgeted level of 1.88 million barrels per day. As at June 2022, the subsidy expenditure of the country on imported petrol was said to be N1.243tn per month.

These factors have led investors to tread lightly with Nigerian Bonds despite their high yields.

Leave A Comment