Credit matters can often seem perplexing, and one common source of confusion is the interchangeability of Credit Rating Agencies (CRAs) with Credit Bureaus. Adding to this mix-up, credit bureaus are sometimes referred to as “Credit Reporting Agencies.” However, it’s imperative to clarify that these two entities diverge in their creditworthiness evaluations.

Credit Rating Agencies have a distinct mission: they evaluate the creditworthiness of various entities, encompassing countries, states, and municipalities, all with the investor’s interests at heart. Conversely, credit bureaus operate on an entirely different stage. They diligently gather data on individual consumers, aiming to decipher their creditworthiness, which they subsequently provide to lenders. These credit bureaus meticulously construct credit histories for consumers. These credit histories serve as a vital tool for potential lenders who seek to appraise a borrower’s creditworthiness.

The assessment process conducted by credit rating agencies is multifaceted. They analyse a multitude of factors, spanning from a company’s financial stability and the industries and markets in which it operates to its fundamental business characteristics and underlying investments, among others.

In stark contrast, a credit bureau’s modus operandi revolves around the data furnished by financial institutions, mortgage lenders, credit card companies, retailers, and other businesses that share a credit relationship with individual consumers. The data collected encompasses payment punctuality, defaults on debts, and similar information. This trove of data is meticulously compiled and scrutinized by the credit bureau to produce a comprehensive credit report. It’s important to note that these reports do not contain details regarding an individual’s income or assets.

The practical application of a credit report comes into play when an individual seeks a loan or a line of credit from a lender. The lender, before extending credit, initiates a credit check, entrusting this task to a credit bureau.

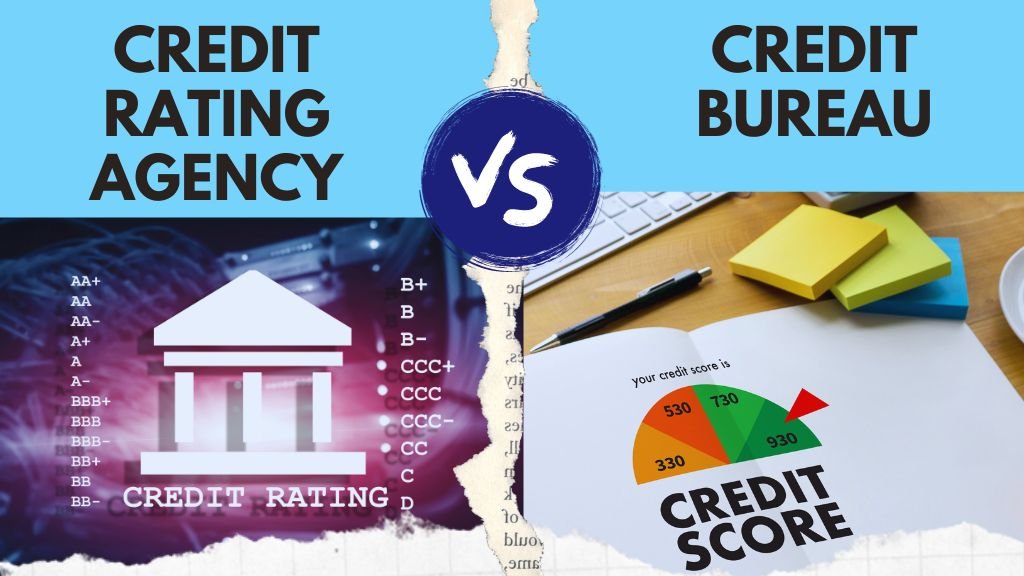

Upon conducting an exhaustive evaluation of an individual’s credit history and financial behaviour, credit bureaus derive a numerical representation known as a credit score. This score typically falls within the range of 300 to 850. The higher the score, the lower the perceived risk associated with the individual. Consequently, individuals with higher credit scores often enjoy more favourable access to credit facilities compared to those with lower scores.

On the flip side, credit rating agencies concern themselves with assessing a company’s ability to repay borrowed sums. They assign a credit rating, which adheres to a scale ranging from AAA (the highest) to D (the lowest).

It’s crucial to understand that a credit rating merely offers a forward-looking perspective regarding an issuer’s creditworthiness. It should never be misconstrued as an investment recommendation or advice to buy or sell securities.

Leave A Comment