On Thursday, 19th May 2022, the Sri Lankan Central Bank Governor announced that the oldest democracy in Asia had fallen into a ‘’pre-emptive default’’ on its debts after the expiry of a 30-day grace period for missed interest payments on two of its sovereign bonds.

This is the first default by an Asia-Pacific nation in recent history.

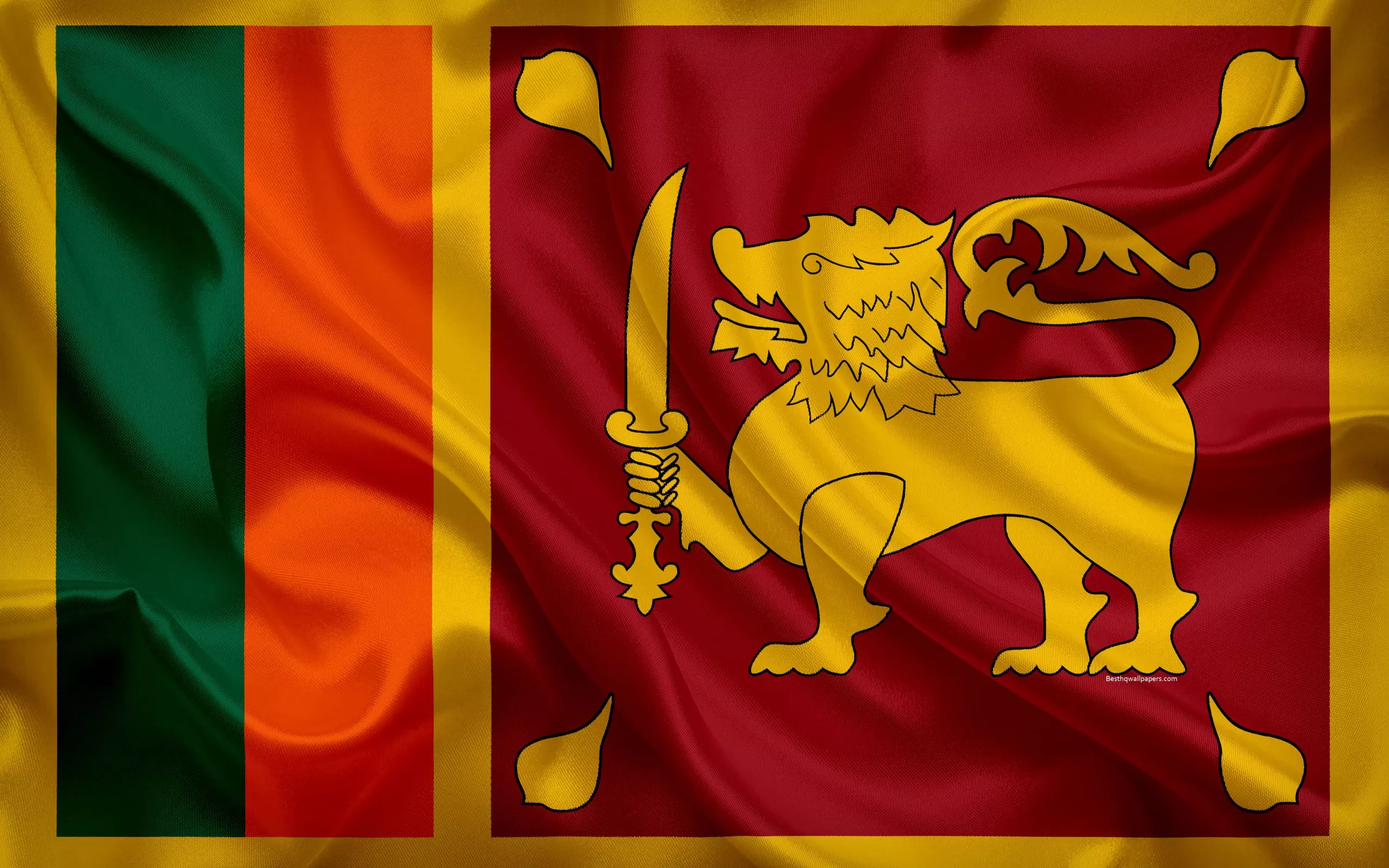

Sri Lanka is an $81 billion economy located off India’s southern coast, which has been mired in turmoil amid annual inflation running at 30%. This has resulted in a plummeting currency and an economic crisis that has left the country short of the hard currency it needs to import food and fuel.

As Sri Lanka struggles with the turmoil, its problems provide a warning for other emerging markets, including Nigeria, where heavy debt loads are converging with economic and social unease. The challenge is made more difficult as the central banks of these economies of emerging markets resort to the orthodox economics of raising interest rates in a bid to quell inflation, leading to higher borrowing costs and stifling productivity.

At least 14 developing economies tracked in a Bloomberg gauge have debt yields at an excess of 1,000 basis points over US Treasuries, a threshold for bonds to be considered distressed. Over a dozen emerging markets have dollar debt trading in distress.

As if the bad governance has not dealt enough blows, the Russia-Ukraine’s war has come to raise the default risk for distressed economies.

The added pressures of rising food and energy prices have already started to bubble up in other countries, including Egypt, Tunisia and Peru. It risks turning into a broader debt debacle and yet another threat to the world economy’s fragile recovery from the pandemic. Bloomberg Economics recently noted that Pakistan, Ethiopia and Ghana are also in danger of following suit.

As the dollar rates move higher, a lot of the fundamentally weaker countries with dollar-denominated debt may struggle to repay bonds. Sri Lanka’s impending default on $12.6 billion of overseas bonds is just a bellwether flashing a warning sign to investors in other developing nations that surging inflation is set to take a painful toll. The root causes are the same all over:

- Clueless oligarchy or democracy of many African nations

- Shortages exacerbated by inflation, including record-high food costs

- Years of excessive borrowing to fund bloated state companies and generous social benefits

- Widespread violence and ethnic clashes across several parts of the country

- Economic crises heralded by hunger and blackouts and;

- Debt loads converging with economic issues and social unease.

Leave A Comment