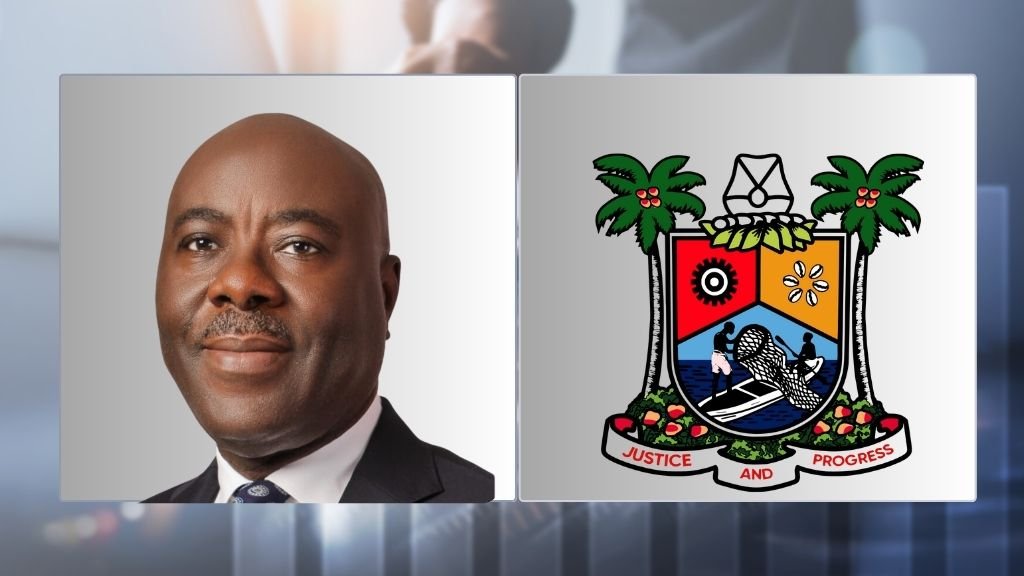

Lagos State is preparing to launch one of the most ambitious sub-national financing initiatives in Africa—a new asset securitisation model set to reshape how governments fund infrastructure. In an exclusive conversation, the Lagos State Commissioner for Finance, Mr. Abayomi Oluyomi revealed that the initiative is not just a financial strategy but a structural shift in how the state intends to unlock value, mobilise capital and accelerate development.

Unlocking Idle Assets, Redefining Funding

According to the Commissioner, the motivation is simple: Lagos requires up to ₦20 trillion in infrastructure financing to remain competitive as a 21st-century megacity. Budget allocations and traditional borrowing can no longer keep pace with the scale of demand. “We have identified and categorised over 300 state-owned assets,” he explained.

Through securitisation, Lagos State will package selected assets into portfolios that can be sold to investors through a Special Purpose Vehicle (SPV), a structure that keeps the state from becoming a direct obligor. This ensures the state’s debt service ratio remains below global sustainability thresholds while still raising large volumes of capital. It even creates room for tokenisation, enabling digital and fractional investments—an emerging trend that allows ordinary Lagosians to invest in state projects.

A Potential Game-Changer for Nigeria’s Capital Markets

Market watchers may soon witness a significant deepening of Nigeria’s financial markets. While securitisation is not new in Nigeria, previous deals largely involved the private sector and federal government entities. Lagos is now set to scale it to a new level.

“A multi-billion-naira state-level securitisation will fundamentally reshape the market,” he said. This will introduce innovative products, accommodate both retail and institutional investors, and encourage broader participation in governance.

A Blueprint for Other States and African Cities

With this, Lagos is set to establish a replicable model for other subnational governments in Nigeria and across Africa. Many states face similar constraints: rising populations, widening infrastructure gaps and limited fiscal space.

“Lagos has always been a forerunner,” he said, referencing the state’s history of innovative financing, including its ₦14.8 billion Green Bond, the first sub-sovereign climate impact bond in Africa, and a ₦230 billion bond that was oversubscribed.

Fueling MSMEs, Jobs and Grassroot Prosperity

Beyond the big-ticket infrastructure, Lagos intends to redirect budget savings to social and economic programs.

Since securitised assets will now fund major infrastructure, the regular budget can channel more funds into MSMEs, youth entrepreneurship, skills programs and trader support schemes.

Revitalizing Dormant Assets into Productive Engines

Securitisation is not just about raising money; it is about reviving halted or inactive state assets.

Idle lands, old buildings and fallow properties will be transformed into logistics hubs, technology parks and commercial spaces, fueling job creation and attracting private investments. The approach includes concession models where private operators upgrade and sustain these assets for predetermined periods.

Upcoming megaprojects such as the Fourth Mainland Bridge are expected to benefit from this renewed access to capital.

Navigating Regulatory and Market Hurdles

Executing a securitisation program of this scale is not without challenges. The Commissioner highlighted the need for airtight documentation on asset ownership, clear bankruptcy provisions, strong governance structures, credit enhancements and independent ratings by SEC-approved agencies.

Transparency, he said, will be the cornerstone of market trust.

Beyond 2026: The Future of Securitization in Nigeria

The Commissioner anticipates that securitisation will become a mainstream financing tool for subnationals.

“As more places see how effective it is, new kinds of asset-backed products will emerge. This opens the door for more investors and helps the whole financial system become stronger, with more options for states to fund growth responsibly.”

His message was clear: the future belongs to governments willing to innovate.

“The biggest lesson is to think creatively and leverage every possible resource.”

Leave A Comment