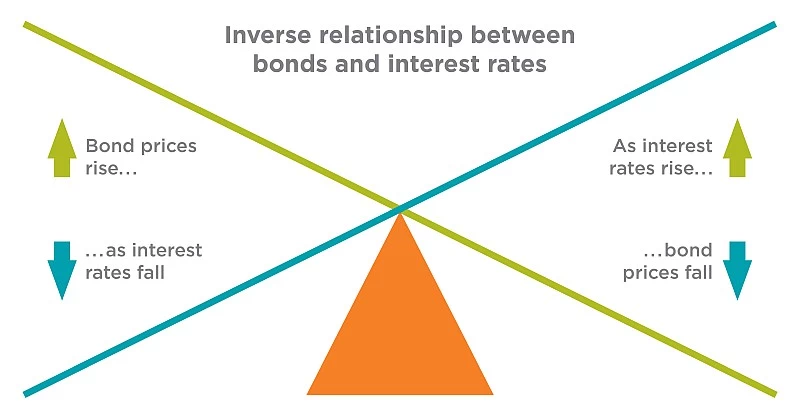

Bonds have an inverse relationship to interest rates. When the cost of borrowing money rises (when interest rates rise), bond prices usually fall, and vice-versa.

At first glance, the negative correlation between interest rates and bond prices seems somewhat illogical. However, upon closer examination, it becomes reasonable.

Bond Investors, like all investors, typically try to get the best return possible. To achieve this goal, they generally need to keep tabs on the fluctuating costs of borrowing.

An easy way to grasp why bond prices move in the opposite direction of interest rates is to consider zero-coupon bonds. They do not pay regular interest and instead derive all of their value from the difference between the purchase price and the par value paid at maturity.

Many bonds pay a fixed rate of interest throughout their term. Interest payments are called coupon payments, and the interest rate is called the coupon rate.

Zero-coupon bonds are issued at a discount to par value, with their yields a function of the purchase price, the par value, and the time remaining until maturity. However, zero-coupon bonds also lock in the bond’s yield, which may be attractive to some investors.

For example, if a zero-coupon bond is trading at N950 and has a par value of N1,000 (paid at maturity in one year), the bond’s rate of return at present is 5.26% ( (1,000 – 950) ÷ 950) x 100 = 5.26). In other words, for an individual to pay N950 for this bond, they must be happy with receiving a 5.26% return.

This satisfaction, of course, depends on what else is happening in the bond market. If current interest rates were to rise, where newly issued bonds were offering a yield of 10%, then the zero-coupon bond yielding 5.26% would be much less attractive. Who wants a 5.26% yield when they can get 10%?

To attract demand, the price of the pre-existing zero-coupon bond would have to decrease enough to match the same return yielded by prevailing interest rates. In this instance, the bond’s price would drop from N950 (which gives a 5.26% yield) to approximately N909.09 (which gives a 10% yield).

Having figured out how a bond’s price moves in relation to interest rate changes, it is easy to see why a bond’s price would increase if prevailing interest rates were to drop. If rates dropped to 3%, the zero-coupon bond, with its yield of 5.26%, would suddenly look very attractive. More people would buy the bond, which would push the price up until the bond’s yield matched the prevailing 3% rate. In this instance, the price of the bond would increase to approximately N970.8

Most bonds pay a fixed interest rate that becomes more attractive if interest rates fall, driving up demand and the price of the bond.

Conversely, if interest rates rise, investors will no longer prefer the lower fixed interest rate paid by a bond, resulting in its price decline.