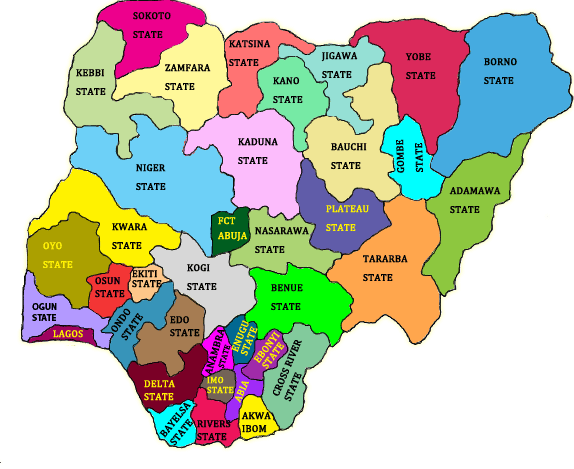

It could as well count as part of the dividends of democracy.

The States (Sub-nationals) in Nigeria are now embracing financial transparency and full disclosure in order to deliver more developmental projects for their people.

Is it not cheering news that Subnational borrowing from the capital market (debt market) is now on the rise? All thanks to more transparent budgetary and financial management on the part of the States.

Credit ratings are a prerequisite for subnational governments to access the capital market, particularly the international capital market to finance infrastructure investments. Over the years, subnational credit ratings have helped enhance fiscal transparency, price risks and returns, and facilitate capital market participation in fiscal monitoring and surveillance.

Since Debt financing serves as a provider of a better matching of maturity terms with the asset life of the infrastructure, Subnational governments with fiscal strength in Nigeria are increasingly looking to the local debt market to fund some of their infrastructure projects.

The aspects of the Subnational economy that most Credit Rating Agencies (CRAs) cover are; the growth prospects of the subnational economy, the structure of the subnational economy, and the demographic variable.

Rating Analysts also considers the fiscal performance of the subnational government, its track record, the flexibility it enjoys in adjusting its future revenues and expenditures, and its ability to manage potential fiscal imbalance.

The ability of the subnational government to adjust both revenue and expenditures to improve its fiscal strength will be a boost to its creditworthiness. Fiscal position is usually examined in these areas: Revenue flexibility, Expenditure flexibility and capacity, and Flexibility in managing budget deficits.

The subnational government’s creditworthiness is also reliant on how it manages its existing balance sheet and improves its debt servicing and repayment capacity. A number of issues are examined in this regard, some of which are; Liquidity and Debt Management, Managing Debt burden, Managing off-balance-sheet liabilities, and Credibility in debt management.

Off-balance-sheet liabilities examined include debt-like instruments or commitments such as leases, majority ownership of enterprises even without explicit guarantees, public-private partnerships and securitizations for which the subnational government is or may become responsible. These may represent efforts by the subnational governments to circumvent debt limits imposed on them.

However, so many Sub-nationals in Nigeria still face challenges when it comes to maintaining a credible reporting and monitoring system. Their ability to address the issue of governance standards and maintain a certain quality in the entire financial system could as well determine their access to unlocking funding through the debt market.

Sometimes, there are major hindrances to fiscal sustainability in States legislative mandates of central vis-à-vis subnational governments and the intergovernmental finance system. A good track record of creditworthiness allows subnational governments to raise funds in the capital market and also reduce the cost of capital.

Good credit ratings can translate into lower borrowing cost as reflected in the lower spread of the debt instrument.

Interestingly, a country’s overall credit rating could place various restrictions on the subnational government’s ability to raise funds and to change its credit standing. Also, favorable sovereign factors could be a significant boost for subnational ratings.

Changes in sovereign ratings are usually followed by similar adjustments in subnational ratings, especially in the emerging economies. But even if the subnational governments are rated more highly than the sovereign, the gap is unlikely to be large as many aspects of the subnational creditworthiness are heavily influenced (and in many cases, constrained) by what happens politically and economically at the national level.

How important the national controls and restrictions are on the subnational rating process depends on whether they translate to certain policy, institutional and management changes on the part of the subnational government. The national government can directly affect the subnational ratings through the restrictions it places on the subnational government revenue and spending profiles. Subnational governments also face constraints in adjusting their own tax revenues. In many countries these constraints are set by their respective constitutions and legislation on tax policy and administration.

In conclusion, both sovereign and subnational ratings are assessed using a framework that encompasses the political, economic, fiscal, financial and institutional factors, even though they play more of a role in the sovereign process. It is also important to note that rating methodologies are not static; they change in scope and emphasis in response to the changing structure of the entities being rated.